When considering where to invest or relocate, having clear priorities and understanding the potential of a location is crucial. Here, we explore why Dubai stands out as a premier destination for real estate investment and what the future holds.

Growth of Tourism and Influx of Wealthy Residents:

Dubai consistently ranks among the world’s top cities, attracting millions of tourists and residents alike. In 2023, the city’s hotels achieved record occupancy rates, underscoring its appeal as a global tourism hub. The influx of wealthy individuals to the UAE has also been notable, with thousands of millionaires relocating here annually, drawn by the country’s stability, business-friendly environment, and attractive tax policies.

Factors Driving Investment in Dubai:

Dubai offers a unique blend of factors that make it a compelling investment opportunity:

– Security and Stability: In an uncertain world, Dubai stands out for its robust regulatory environment and respect for the rule of law, providing a secure base for investments.

– Tax Advantages: With competitive tax rates, Dubai attracts businesses and individuals seeking to optimize their financial strategies.

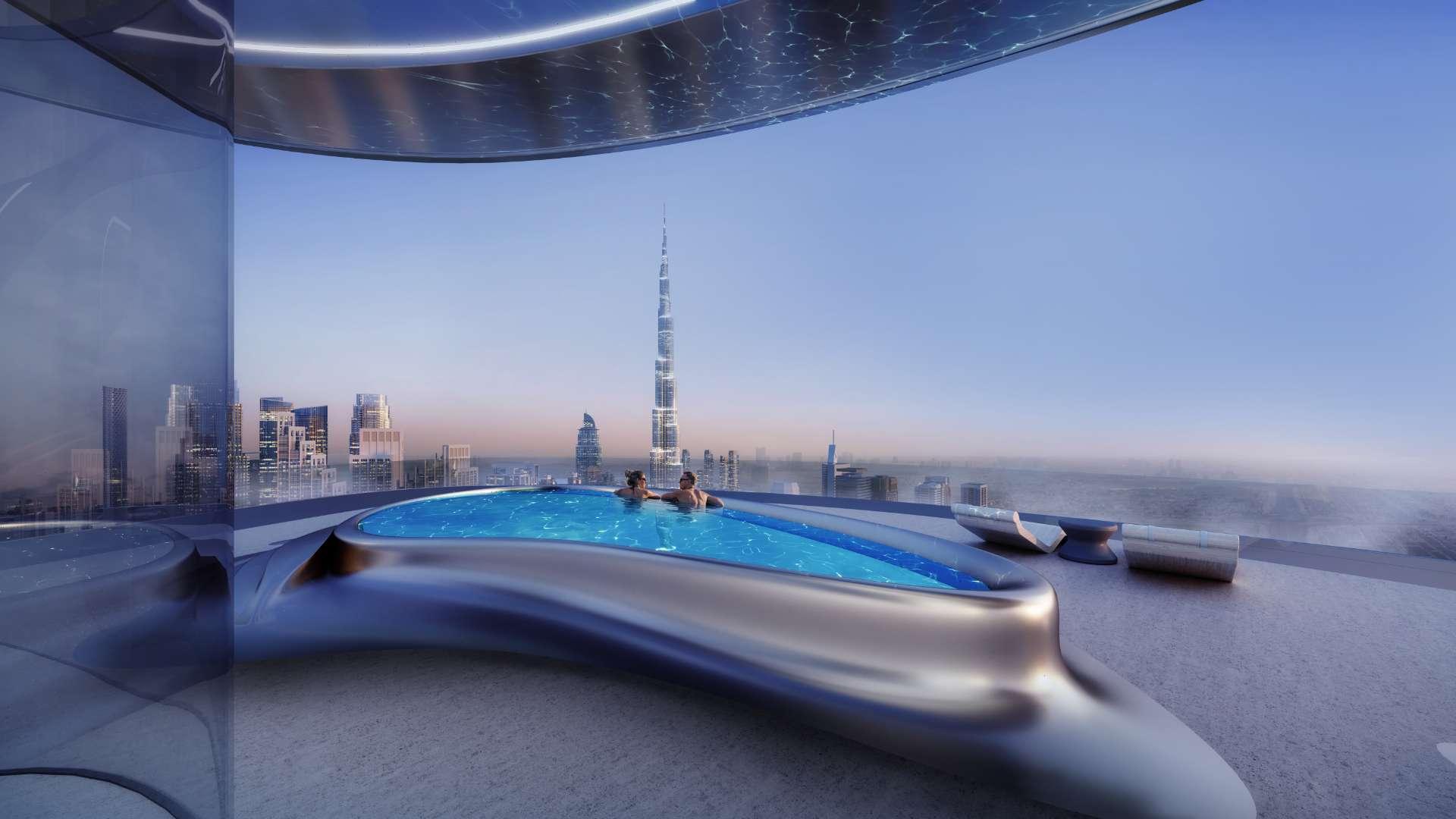

– High-Quality Lifestyle: From luxury shopping and dining to world-class entertainment and medical facilities, Dubai offers a lifestyle that appeals to affluent investors.

– Strategic Location: Situated as a gateway between East and West, Dubai’s strategic location enhances its attractiveness as a global business and logistics hub.

Why Invest in Dubai Real Estate?

1. Capital Appreciation: Dubai’s real estate market has shown consistent growth, with certain areas seeing substantial increases in property values. Investments in well-chosen properties can offer protection against inflation and potential for significant appreciation. For example, property values in areas like Dubai Marina and Downtown Dubai have increased by up to 20% over the past few years.

2. Rental Yield: The demand for rental properties remains strong, supported by a growing population and ongoing infrastructure developments. Rental yields in Dubai are competitive compared to global standards, typically ranging between 5-8% annually. For instance, rental properties in Jumeirah Lake Towers offer yields around 6.7%, while those in Jumeirah Village Circle yield about 6.3%. High-demand areas can even see yields up to 13% for short-term rentals.

3. Future Development: Dubai continues to invest in ambitious projects like the revitalization of Palm Jebel Ali, demonstrating a commitment to sustainable growth and enhancing property values over time. Dubai’s urban planning is unparalleled, especially with the expected launch of Al Maktoum International Airport—the largest airport in the world. These projects are expected to drive further appreciation in property values, with some areas projected to see increases of 10-15% annually.

Is Now the Right Time to Buy?

While some may wait for market corrections, Dubai’s strategic plans for development and population growth suggest a resilient market outlook. The city’s ambitious goals aim to enhance quality of life and sustain economic growth, making it unlikely for property prices to revert to previous levels. Currently, average rental yields for long-term rentals in Dubai are about 7-8%, while short-term rentals can reach up to 13%.

Connect with Us

At ShareSquare Properties Dubai, we specialize in guiding investors through Dubai’s dynamic real estate landscape. Whether you’re considering an investment or relocating to Dubai, our team is dedicated to helping you achieve your goals with personalized service and unparalleled expertise.